The psychology and lingo of crypto trading

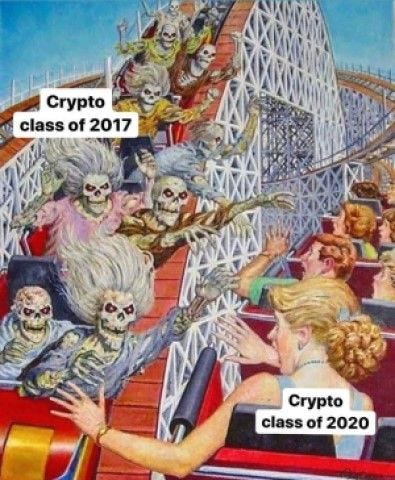

If you're new to crypto then you must be feeling a roller coaster of emotions trying to understand the industry. Maybe you're asking yourself questions such as...

How do I know which coin to buy?

When should I sell?

Why is crypto so volatile?

What are bear and bull cycles?

Entering the crypto market is an exciting feeling! You're part of technological, financial, and economic revolution. Like every revolution it can be a bit chaotic. I'll help you understand the language, lingo, and mindset of this industry.

Moon or mooning - refers to the speculation of a crypto asset going to a high price value.

What's the best coin to buy?

Great question and a great opportunity for "shillers". Shillers are people who have invested in a crypto that they think will moon and to try persuade you on buying it. Typically they take advantage of newcomers by convincing them to buy crypto so that value increases to give the shillers an opportunity to sell their holdings for profit. Leaving the newcomer with a large holding or "bag" of rather useless crypto.

Sometime shillers don't even know they are doing it. This psychology is also known as confirmation bias: the tendency to search for, interpret, favor, and recall information in a way that confirms or supports one's prior beliefs or values. People show confirmation bias when they select information that supports their views, ignoring contrary information, or when they interpret ambiguous evidence as supporting their existing attitudes.

Research until the point that you are confident in your knowledge about your money vehicles.

Whenever you are thinking to buy a crypto asset it's important to do your own research. Look up the founders and read their whitepaper. Join their telegram or discord channels and ask questions about their coin economics. Look at the trading volume, total supply, circulating supply, and market cap:

Trading volume - Total value, usually in USD, that's been traded in a 24 hour period. Bitcoins 24 hour volume at the time of writing is $60.5 billion.

Total supply - The max amount of coins a certain cryptocurrency can ever have. Bitcoins max supply is 21 million.

Circulating supply- The current amount of coins that exist. There's 18.6 million bitcoin as of now in the world.

Market Cap - Is the circulating supply multiplied by the coins price. Bitcoins market cap ( 18.6m * $63,429 = $1.18 trillion).

Looking at these numbers for bitcoin, I can tell that it's a healthy, active, and liquid asset. You must evaluate a crypto's stats with your own lens to determine what is the best crypto for you to put your money in. CoinGecko lists all the crypto stats.

The term "hodl" came from a drunken forum post of someone misspelling hold. It has taken off in the crypto world and repurposed to mean "hold on for dear life."

When should I sell?

There's a different strategy for everyone. A safe bet is to sell as soon as you have a decent profit margin, a common choice is around +20% gain. Some "hodl" forever because they believe their crypto of choice is the future. Everyone wants to make money and it's up you when you want to realize your profits....or losses.

Be careful "fudders". They are people who intentionally create "fud" - fear, uncertainty, and doubt. These people try to scare you away from a crypto project. Which can cause emotional distress to sell what you have. With proper knowledge of your crypto fudders can be easily exposed.

A whale is someone who owns a large amount of crypto, enough so that their trade volume can change a crypto asset's value.

Why is crypto so volatile?

Just like anything that's new, people rush in on the hype. Which creates a spike up in price and then a hard drop down when people sell to collect profit. Then it settle's for a bit until the next wave. What makes crypto especially volatile is that it's open for trading 24/7 to the entire world. The media speculates on the price which drives the demand for a limited supply. There's over 7.8 billion people in the world and only 21 million bitcoin to go around. Don't worry the smallest unit of bitcoin is one hundred millionth (0.00000001 BTC) or 1 satoshi.

Bear vs Bull cycles?

These terms apply to crypto markets the same as they do to traditional markets.

A bull market is a sustained rising crypto or stock market, sometimes defined as a 20% rally from a recent low. Bulls are optimistic the market will continue to rise.

A bear market is triggered when the market falls 20% from a previous high over an extended period of time. Bears are pessimistic about the future and expect the market to fall.

This is easy enough to understand from a technical stand point. The tough part about being in these cycles is keeping emotions under control. A bull market is exciting! Everyone is saying crypto is going to the moon! Buy in now before you lose your chance! So you rush into buying bitcoin, feeling giddy because the charts are green. Then after a few weeks or months, the price starts dropping. That sinking feeling hits. Oh no, all that money put in is going to be lost. Better cut loses before you lose everything. So you sell and went through this emotional roller coaster for nothing...well actually you paid for it. The winners are the shillers who sold when they realized a profit.

To avoid being caught in a hectic bull cycles, you need to have a strategic plan. Know what your real goals are. Are you trying to day trade and make a quick buck? Are you a long term holder? A little of both? Play with what you're willing to lose.

ATH - All time high. The highest value the coin has even been.

All of a sudden you're in a bear cycle. The market is lower than the ATH that it hit during the bull cycle. Everyone is quiet, the chart is moving sideways, emotions are indifferent, and it's not expected to go up. This is when all your hard work in researching those coins come in. You can make an educated choice in this relatively cheap time to buy in. Buy low and sell high, right?

It's impossible to fully understand the market and what to expect from it. People study this as a profession, and even they don't know. There's conservative, moderate, and aggressive styles of investing. Pick your ride, do your research, decide what you're willing to lose, and leave your emotions out of it.